Ashley Has an Individual Medical Expense Insurance

An insured owns a 50000 whole life policy. If M incurs a 2200 claim for an eligible medical expense how much will M receive in payment for this claim.

Healthcare Gov Is Fundamentally Flawed Infographic Healthcare Infographics Infographic Health Infographic

At the age 47 the insured decides to cancel his policy and exercise the extended term option for the policys cash value which is currently 20000.

. Comprehensive medical expense insurance covers all of the following EXCEPT. Basic medical expense insurance often referred to as first dollar insurance pays benefits up front without the patient having to first satisfy a deductible. The structure of commercial health insurance products available in the state varies widely.

C Sarahs doctor is responsible for all the expenses associated with. CHALLENGE 1 Sarah has a health insurance policy that has a copayment for each doctors visit. Under IRC Section 213 d 1 D premiums for long-term care insurance are deductible along with other individual medical expenses.

Michigan insurance policies can specify a time limit on the number of years that an insured can wait before taking legal action against the insurer. A Sarah is responsible for 100 of the expenses associated with each doctor visit. Ch 5 Practice Study Sheetdocx.

Two additional claims were filed in 2014 each in excess of. The Administrative Services team oversees all aspects of medical insurance billing and medical records at CU Boulder. Best for Pharmacy Programs.

Dallas County Community College. This means that once the insured has paid a specified amount toward his or her covered expenses-usually 1000 to 2000-the company pays 100 of covered expenses after that point. Degree of Medical Care Management.

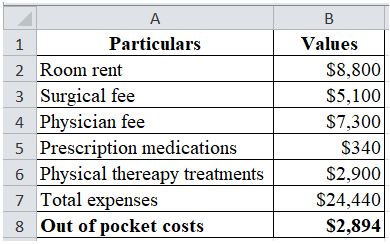

A hospital miscellaneous expenses. How much will Ash-leys insurer pay. An employer-payment plan is a type of account-based plan that provides an employee reimbursement for all or a portion of the premium expense for individual health insurance.

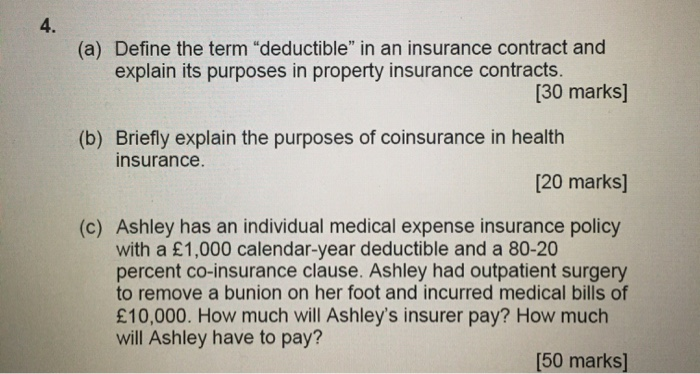

These plans however are limited to a set amount that they will pay and the amount of time they will pay for certain medical services. Similarly about six in ten 63 adults with household incomes under 40000 and 55 of those with incomes between 40000 and 89999 report delaying some sort of care due to cost compared to. Ashley had outpa- tient surgery to remove a bunion on her foot and incurred medical bills of 10000.

Multiple Choice 5-3 Medical Expenses LO 51. Ashley has an individual medical expense insurance policy with a 1000 calendar-year deductible and an 80-20 percent coinsurance clause. Some key differences in how health coverage can be structured are listed below.

131 The Purpose of Medical Expense Insurance. The policy was issued with a 500 deductible and a limit of four deductibles per calendar year. An individual has a health insurance plan with a deductible of 1200 and a coinsurance rate of 50.

If you have any questions about medical insurance billing or medical records please contact one of the Admin. Below is the team dedicated to ensuring students receive the highest quality primary care experience possible. CORRECT TRY AGAIN 6000 less 2000 deductible times 80 coinsurance 3200 Your answer has been saved.

BCBS of Tennessee offers 3 health insurance tiers. Ashley had outpa- tient surgery to remove a bunion on her foot and incurred. Premiums which are waived under the rider do not require repayment upon the insureds recovery.

An HSA is a tax-favored vehicle for accumulating funds to cover medical expenses. Depending on your health care needs you can choose lower-tier plans that have. For an individual in 2012 a qualified high-deductible plan is one with a minimum deductible of _________.

How much will Ashley. M has a Major Medical insurance policy with a 200 flat deductible and an 80 Coinsurance clause. Cost-savings are one of the biggest advantages of Medi-Share and one of the main reasons for the increasing popularity of the program over traditional health care insurance.

Table of contents Show Quick Look. Their demand curve is Q20-P10 and the equilibrium market. Bronze silver and gold.

Many employers have contacted us over the years asking whether they may offer an employerpayment plan rather than offer a traditional group health insurance plan. The cost of disability insurance is not a medical expense. Traditionally health insurance has provided reimbursement for covered medical expenses with little or no oversight by the insurer.

This problem has been solved. If you have already paid for those high-deductible health insurance plans you will be aware of how costly they can be. A HospitalSurgical Expense policy was purchased for a family of four in March of 2013.

This time limit however has to be ___ years or greater. Two claims were paid in September 2013 each incurring medical expenses in excess of the deductible. Ashley had outpatient surgery to remove a bunion on her foot and incurred medical bills of 10000.

Notably to be eligible for deductibility the long-term care insurance must be tax-qualified coverage as defined under IRC Section 7702B b though in practice virtually all long-term care insurance. Under uniform required provisions proof of loss under a health insurance policy normally should be filed within. As long as you have a qualifying health insurance plan -- one with a deductible of 1400 or more for an individual or 2800 or more for a family -- you may set aside up to 3650 if you have an.

Which of the following is true for Sarah. INDIVIDUAL INCOME TAX CHAPTER 5 homework. B Sarah isnt responsible for any of the expenses associated with each doctor visit.

Medi-Share is an accountable program. Ashley had outpatient surgery to. Blue Cross Blue Shield of Tennessee.

In this situation 2200 - 200 deductible x 80 1600. Ashley has an individual medical expense insurance policy with a 1000 calendar-year deductible and a 20 percent coinsurance clause. The Best Illinois Health Insurance.

Which of the following individual health insurance policies will. Ashley has an individual medical expense insurance policy with a 1000 calendar-year deductible and a 20 coinsurance clause. Best for Affordable Health Insurance Plans With Generous Benefits.

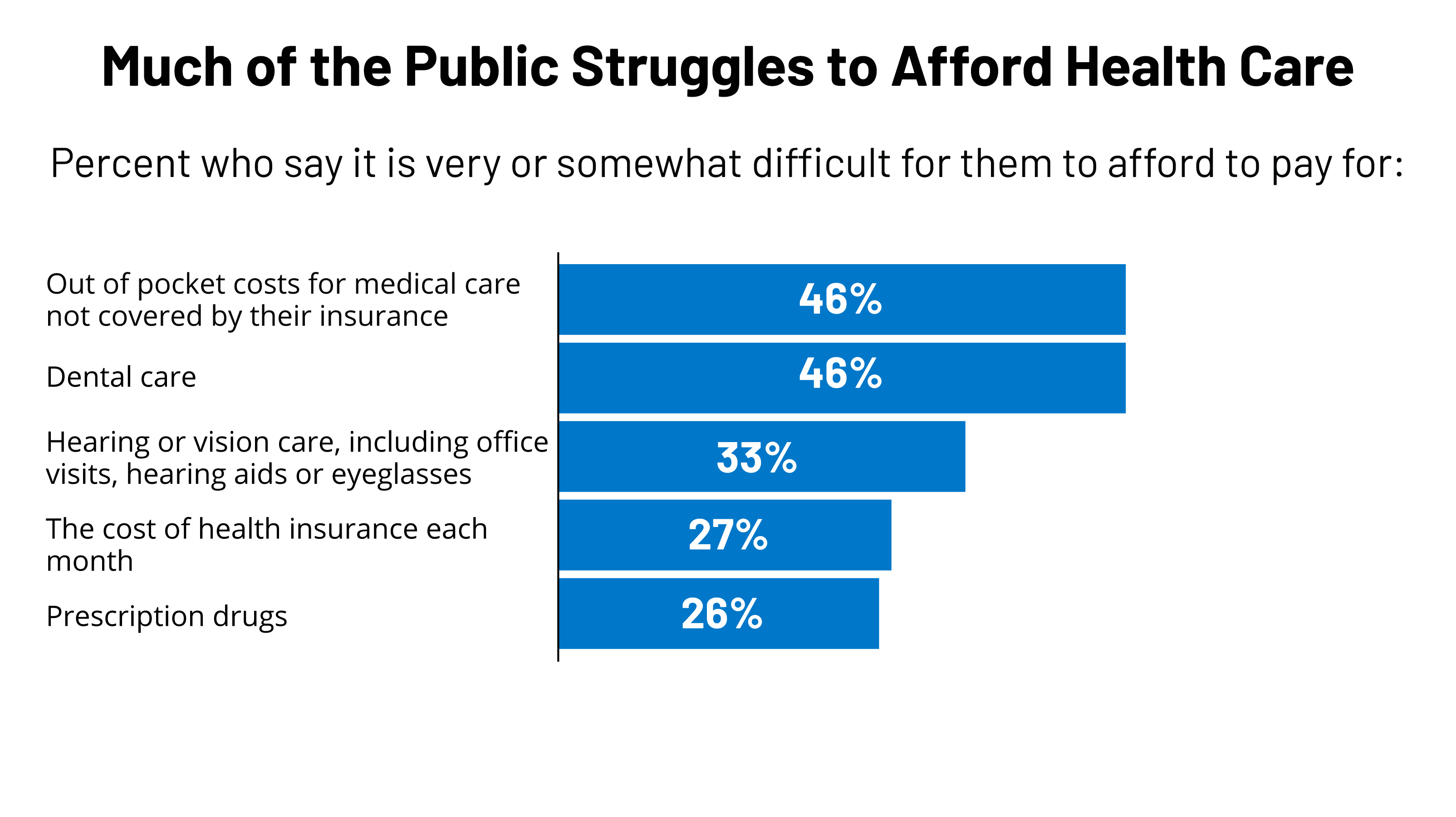

Americans Challenges With Health Care Costs Kff

Solved A Define The Term Deductible In An Insurance Chegg Com

Webmd Better Information Better Health Best Health Insurance Affordable Health Insurance Health Insurance

No comments for "Ashley Has an Individual Medical Expense Insurance"

Post a Comment